Monday, March 31, 2025

Thursday, March 27, 2025

Incredible Streak : 🎌TWO🎌 in a Row with #28 Econach エコナックa Day after #19 Tobishima 飛島 ! { 28th Mar '25 }

The old Nippon Lace , which almost went bust in the '90s and then in the '00s gets partially sold again on the ex-dividend day, its first payout since 1969 ! I had harbored a desire to earn from this stock ever since learning about it obliquely via the book ' Unequal Equities' which I purchased on eBay in 2017, partly due to a mysterious attraction to its name.

And so, a most improbable win manifests from the vortex at least a couple of years into the gestation period, making it two consecutive🎌 wins & 1,198 points in the combined score!!!

Incredible Streak : The Odyssey goes ON with🎌#19 Tobishima 飛島 Exiting on a 2nd Disposal ! { 27th Mar '25 }

It was a tough choice between two 🎌 equities both acquired in 2018 but underperformed thereafter, with Nippon Felt 日本フエルト dropping 33.8% by its pandemic-printed low, while Tobishima 飛島 more than halved from the original ill-time entry very nearly at the 2018 peak! Fortunately, two cost-averaging purchases, & six dividends later, the price was lowered to a tad below ¥1,600 and thanks to generous dividends, the total income surpasses ¥50,000 after today's sale!

The year's take from the Japanese isles thus pops past ¥203,000, already exceeding all the full annual winning tallies since my debut eight years ago, save for 2021 & the last two years, the fastest pace to date both in terms of yen amounts & contributors, the combined score now just eleven points distant from the all-time high as at end-'24!Wednesday, March 26, 2025

Incredible Streak : IJM reprises its role as #37 from the 20th...{26th Mar '25}

With Japanese stocks not really rising as the widespread ex-dividend date looms two days away , #37 IJM has to step in to support the winning streak running not far from empty locally, with only six 🎌 paper gainers left [ likely far less once the 28th arrives ]. & about four locally. Nonetheless, a win is a win is a WIN no matter how small and so the miracle sails on...improbably, incredibly & even miraculously !

Today also witnessed a strange intra-day ramp in Kawase Computer カワセコンピ: the stock suddenly jumped a minute before 2pm Tokyo time & over 415,000 shares were traded before it peaked 5 minutes later at ¥294 before gapping down back to ¥236 & closing at a loss of 2% thus dashing hopes for its role as a streak extender [average price transacted was ¥257.626 ! ].

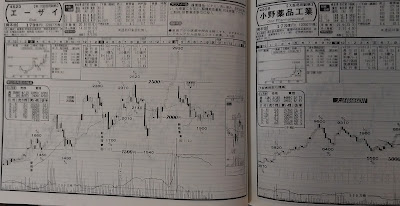

The charts below give a snapshot of financials surrounding the '82 low and the '88 peak, with an adjustment factor of 0.76518 after bonus issues:

Tuesday, March 25, 2025

Will the Japanese equity market bottom in July, 60 years after the major bottom in 1965?

Incredible Streak : 🎌Lonseal ロンシール工業 Spurs the Marathon to 1,155 Days & it's the #15/86 🎌 in '25/since '17! { 25th Mar '25 }

Buying some insurance against drops bigger than dividend quantums anticipated on the 28th when most 🎌 stocks go ex-entitlement. Lonseal ロンシール is paying out a bigger than average ¥70 per share [4.4% yield] & so poses a high risk of dropping way more than the dividend quantum while I'm eyeing many other stocks in that market !

The marathon baton-receiver thus becomes the fifteenth 🎌 scorer this year & brings the tally to 86 since July 2017 with 3 months left to the 8th Anniversary & the target average tally per year upgraded to 11 from ten! In contrast, it took until Aug 19th to attain the same 15 winners last year, almost five months away, making the current pace a scorching one, even in comparison to the record 23 that eventuated in '23 !!!

Monday, March 24, 2025

Incredible Streak : Poh Kong 💎 Gleams 💍 & Takes the Baton two-wards 1,154 Successive Days ! {24th Mar '25}

The local jeweler first delivered on 31st Jan this year as #13 when sold a tad above $1.01 & 7 weeks later, is pared down to the original 800 shares with another sale $1.05 the day before it goes ex-dividend to attain a combined score of 1,193 points, just sixteen away from besting the all-time high of 1,208 on Dec 31st 2024, tying with 13th Dec as 12th highest!

Friday, March 21, 2025

Incredible Streak : A Swiss food giant's 35-year-listed, 113-year-old local arm feeds a Relentless Streak of Financial Freedom ! {21st Mar '25}

Jazzed to reach a combined score of 1,192 points, leapfrogging over 11th Dec '24's 1,190 score to tie with 13th Dec for 12th Best Score thus far!!! An added cherry on the icing is #5 CelcomDIGI's 3% drop to 6.2% below my final exit a week ago, opening the door to more rounds as I look to re-enter closer to 3 year/14.5 year lows of $3.10!

Thursday, March 20, 2025

After nibbling at Nestlé M'sia shares lately, I finally buy my first hundred shares since Apr 2014!

The local food giant's shares have been in a precipitous fall since announcing a 72% contraction in 4Q '24 profit, breaking the $100 mark decisively & touching a new low of $61.80 today on what seems like desperate panicked selling by big funds all rushing through the narrow door of illiquidity, given that 72.6% of all outstanding shares are held by the Swiss parent Nestlé SA & the EPF has been increasing its stake from below 16 million [6.8%] shares in 2021 to almost 29.9 million [12.7%] as of the last report.

If it can be conservatively estimated that a further 4% of outstanding free float is unshakeable due to long-term horizons of relevant holders, the number of shares in weak hands amount to just over 30 million. About 10% of this figure has been traded in the last 17 market days [~ 2.9 million] and on top of being motivated by the lowest profitability since 2010, could also be fueled by the desperation of funds seeking to lock in any paper gains accumulated over the years before they vanish completely!

A big Fibronacci target of $65-66 [0.618] based on its IPO price of $5 & its all-time low of $7 in '91 has been punctured in the last couple of days, Based on the earliest obtainable revenue & net profit over 34 years ago, projected from the IPO price & its lowest price recorded of $6.50 to the current diminished $415.6 million net profit now, versus an estimated $60 million after tax profit back then, conservative fair value is between $48 - $56.50, significantly below the current quotation.

Many long-term retailers may also be panicking in the current selloff, and so irrationality seems to be the key price driver at the moment, augmented by the 'terrible' numbers & the 17-month boycott movement due to the Israeli attacks on Gaza & Lebanon. The boycott by emotionally-charged natives is ultimately tantamount to shooting themselves in the foot as many factory workers and marketing/distribution employees are likely to be Malay & the company could easily implement massive layoffs to streamline operations & maintain profitability. As distressing & intense as the current bout of selling may be for existing shareholders, the volumes are still dwarfed by the record 5.053 million shares traded on 30th Nov '17, the 1.348 million traded on 30th Nov '23 & the figure of 800,000+ shares traded on individual days in Feb '09, Jun '12, Feb '13 & Nov '16. Further back, 1.835 million shares were traded on 14th Jun '00, 0.653 & 0.678 million traded on 31st May & 1st Jun '06, 0.599 on 12th Aug '98 & 1.663 million on 3rd Feb '98.

Personally, having earned $410 in dividends holding from Apr '14 till Aug '15 & $256 in capital gains selling above $71.50 after buying at $68.52, I draw on my 30+ years in the markets to guesstimate that the rebound is just days away, if not by tomorrow! I am mentally prepared for it to fall to $56 or lower, but believe it's unlikely to happen in a straight line from here! My intuition suggests that the stock price could revisit $88 on the next rebound as more rational market moves reassert themselves among both funds & retailers. A 5-10% margin of error is common in these knife-catching semi-speculations.

Incredible Streak : Fellow construction & property stocks IJM & KLCC take over from YTL's exit yesterday ! {20th Mar '25}

IJM, bought speculatively yesterday as announced, rewards within a day with a 60% paring at a better than expected $2.02 to jointly extend the marathon with #5/'25 KLCC Property REIT to a combined score of 1,190 points, level with 11th Dec '24 as the 14th highest score of all-time up to this juncture!

Wednesday, March 19, 2025

Incredible Streak : YTL Corporation cements a Hat3rick of scoring years by taking the marathon baton ! {19th Mar '25}

18 rounds in each of 2023[#67] & 2024[#7] and two in 2025[#4] sees M'sian outperformer YTL Corporation contribute 38 rounds to the ongoing awe-inspiring, marvelous, resilient train of stock-trading income, effectively contributing 3.3% of the entire streak up to this point!

The last hundred shares sold [leaving only 28 shares, the lowest since 2015] at $1.98 contributes to a re-entry of a small stake in construction rival IJM Corporation for the first time since August 2022, a stock which plunged >10% today before it was semi-speculatively bought, targeting a modest $1.99 in case of a sharp rebound!

Tuesday, March 18, 2025

Incredible Streak : S'pore's Ellipsiz forced-marches to 1,150 Successive Market Days ! {18th Mar '25}

I refused to allow the local nuisance holiday to delay my relentless march towards fresh, all-time awe-inspiring highs as neighbouring Ellipsiz , a massive 34% dividend-returner in the last half-year, is finally disposed entirely after a 9-year absence from winners' circles to bring the combined tally to 1,188 points, the highest since Dec 9th's 1,188 points, making them the joint 16th highest scores ever thus far !

Monday, March 17, 2025

So💖💟😉oo Appreciative of the Paper Gains on recent purchases of Fujisash 不二サッシ, NTT 日本電信電話, Lonseal ロンシール, Sakai Heavy 酒井重工業, Sansha 三社電機製作所 & Sawafuji 澤藤電機 !!!

As at 10am on 18th March, they stand as follows:

💝 Fujisash 不二サッシ = ¥ 7,100

💝 NTT 日本電信電話 = ¥ 2,900

💝 Lonseal ロンシール = ¥ 8,200

💝 Sakai Heavy 酒井重工業 = ¥ 6,100

💝 Sansha 三社電機製作所 = ¥ 4,100

💝 Sawafuji 澤藤電機 = ¥ 2,400

Obviously, many Japanese are chasing these stocks, among many others, for upcoming dividends all going ex- in ten days' time but it's still heartening to dwell on the fact that these add up to ¥ 30,800 [actually closer to ¥ 36,000 if end-'24 acquisitions Komai Haltec 駒井ハルテック & Ono Pharma 小野薬品工業 are included] or almost 7 trading commissions! Total net dividends expected to be paid out by July amount to ¥15,762 or over half the amount saved.

Incredible Streak : Challenging CIMB Hattricks in the last Half Year to Set another Fresh High ! {17th Mar '25}

After declining -61.8% at its lowest point in 2020 from the unfortunately-timed entry in Aug 2013, banking giant CIMB partially exits a 2nd averaging-down re-purchase on Thursday at $7.29 [vs $7.008] on a LIFO basis despite going ex-dividend on Friday, allowing a few ringgit in 'contra' gains to snatch another well-deserved victory from the jaws of Fate & perpetuate the winning streak to 1,150 in a row! The higher-priced $7.60+ shares can be held for another 11 years if necessary to reap more payouts!!

Sunday, March 16, 2025

Friday, March 14, 2025

NTT's peak during the Dot.com Bubble in 2000

The newest member of my Japanese portfolio actually peaked at the end of 1999 slightly above last year's apex of ¥192.9:

lt peaked at around the time when the EPS climaxed at an adjusted equivalent of ¥2.4271: ergo, current EPS is 5.47x that apex while 2025's dividend is 5.2x the ¥10,000 per share payout in 1999.

Incredible Streak : CelcomDIGI Earns in EIGHT of the last 13 Years to Reach 1,148 in a Row! {14th Mar '25}

My mobile service provider has contributed capital gains in 2013,2015,2016, 2019,2021-2022, 2024 & 2025 on top of at least 23 dividends in the interim, earning $462.29 in the last 5 years from long positions that never went beyond 1,018 shares & for much of that time amounted to less than 330 shares!

Today, CelcomDIGI conjures 1,149 successive days of stock trading income & reaches 1,184 in the points category, thus tying with 5th Dec '24 as the 18th highest score of all-time!

Thursday, March 13, 2025

Incredible Streak : APM Earns the SIX-Consecutive-Year Badge of Honour! {13th Mar '25}

For someone who has never owned a car, I sure have scored on quite a few auto-related stocks : Subaru, Petronas Dagangan, Oriental Holdings, Petron M'sia and others. Today, another rare 6-year-in-a-row scorer joins an exclusive club of less than 10, including the second stock in the above list, thus stretching the marathon to another fresh record by exiting finally after its maiden entry in 2017, paying fifteen dividends!

It often stepped in, both during the 2nd longest run in 2017/2018 & in the current magnificent ongoing marathon, whenever it seemed there were scant candidates up to the task! Thank you for your services, APM Automotive, & garnering 1,183 combined points, tying with 4th Dec '24 for 19th position on the all-time list!!

Wednesday, March 12, 2025

Incredible Streak : The Petronas Twin Towers contribute a Hat3rick as #5! {12th Mar '25}

With the rank of paper gainers thinning out in the face of persistent bearish selling, KLCC Property/REIT is a rare bastion of relative stability, trading close to its all-time high of $8.64 on Dec 29th 2017 when it was artificially driven up for window-dressing on the last trading day of that year.

Thus, it is pared down to just 6.6% of the peak stake at the beginning of 2024 for a 17% capital gain after earning at least 31 dividends ever since my first involvement with the stock in early 2014!

Tuesday, March 11, 2025

Incredible Streak : 🎌Tsutsumi ツツミ 💎Sparkles💍 for Me Today to Garner Fourteen/85 🎌 Scorers! {11th Mar '25}

Purchased a day before last year's final ex-dividend date, Tsutsumi ツツミ, a🎌 jeweler is chosen to extend the streak to 1,146 days consecutively & in the process, it becomes the fourteenth 🎌 scorer since the beginning of 2025, resuming a scorching pace & comprising an all-time high proportion of 40% of all winners thus far from those enigmatic isles!

In the last fifty months of possession, it has thus earned a decent 7.8% ROI [ 8% annualized] excluding forex effects & brings the Tokyo cumulative total to eighty-five since July 2017, averaging eleven per year at this juncture. It also represents a trio of two/more consecutive foreign earners in the last few weeks: beginning with the then record 5 overseas stocks in a row run from 10-14th Feb which was quickly superseded by the incredible 8 consecutive foreign earning days from 23rd Feb till 5th Mar.

If my previous experiences trading there have not vindicated the excitement leading up to my debut in Tokyo around July 2017, this year's accomplishments certainly have, as it's an incredible feat considering how the Nikkei has been trapped within a range essentially since last August's meltdown before breaking down in the last few days below 37,000! Last year, it took until Aug 19th to attain the same cumulative tally & the icing on top of this cake is the surpassing of 2017's total ¥ earnings from July till December during my maiden year there.

Monday, March 10, 2025

Incredible Streak : The FINAL EXIT of 🐉Alibaba 🏮! {10th Mar '25}

Thus, a long 42-month odyssey with the Chinese internet e-commerce giant & AI-giant wannabe is concluded with a 100% win record & 7 rounds since 2021 [ 2 in HK & 5 in the US] after 2 dividends, a looming threat of delisting, a scuppered IPO, crackdowns targeting the founder & a maximum -62% paper loss at the stock's nadir in late 2022!

Alibaba also remains the only Hong Kong-listed stock to provide a 'contra' profit [entry & exit within the settlement period] in my decade-long history trading there, and tonight brings the combined score to 1,178 points, tying with 28 Nov '24 for 23rd highest score, exiting tonight at an average $135.414, the highest-priced sale of all rounds excepting the Aug 2021 sale. Not bad, considering that it closed 2.1% lower at $132.54 amid a market-wide selloff, especially in tech stocks !

Friday, March 07, 2025

Incredible Streak : #3 Sungei Bagan delivers a quartet of rounds after scoring 17x in 2024 ! {7th Mar '25}

For a stock that mainly disappointed since it re-entered the margin account in late 2021, Sungei Bagan delivered from Day 1 last year & it is partially disposed for over 20 times & today serves up helping #21 as scorer N°3 [N°1 in 2024] to attain 1,144 successive days in the precious, incredible, enduring marathon of financial freedom! Leaving a small remainder 321 share stake in the non-margin account.

In Japan, latest purchase NTT 日本電信電話 falls a slight 0.27% despite the main Japanese index's 817.76 point, or 2.17% plunge, perhaps because it is relatively unaffected by the Trump-riff rampage that's driving the current worldwide equity selloffs.

Thursday, March 06, 2025

My journey with NTT 日本電信電話 finally begins 10th March!

That is the day payment will be due for the shares bought today from ¥146.3 up to ¥146.8. Its 1987 IPO zenith was ¥311 [unadjusted = ¥3,180,000] when it was a dreamy stock whose market cap exceeded that of the stock exchanges of Germany & Hong Kong combined & IPO-ed at ¥1,200,000 with a P/B of 5.4 & a PE of 126!

At the current price, PE is 11 & P/B is around 1.2 with dividend yield of 3.5% compared with just 0.4% back in 1987! Revenue has more than doubled,+150%, since that bubbly debut 38 years ago, to a record ¥13.374569 trillion while capital adequacy is about 3 points lower at 33.2%. Total assets have swelled to over ¥30 trillion from ¥10.67 trillion at the zenith of the bubble in Jan '90 when the price had already deflated 54% from its Apr '87 apex, slightly above the current price as it turns out! With both commissions factored in, I have to sell at over ¥155.4 to earn a capital gain, with around ¥1,750 in dividends scheduled to be paid in July, covering over 1/3 of one commission.