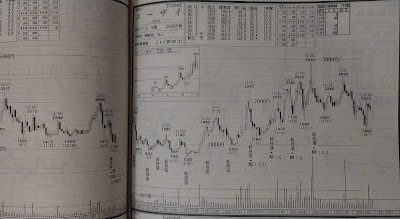

WOWOW [watching]:

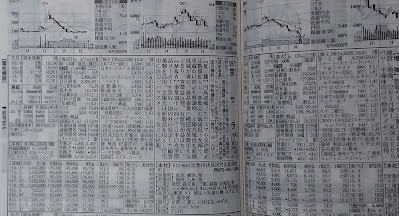

JAL & ANA in 1991:

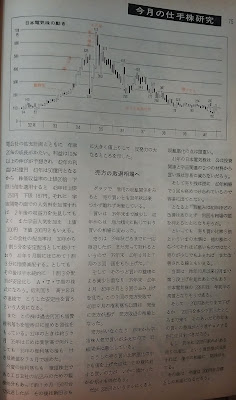

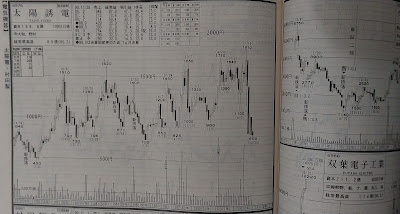

Taiyo Yuden in 1976, 1978, 1979, 1988, 1989, 1991,1998, 2000, 2002,2005, 2013 & 2023 [stalked but missed]:

Rohm in 1985,1989,1991,1994, 1996, 2005, 2013, 2016 & 2023 [bought & SOLD for 10% profit] & Hamamatsu Photonics in 2019 & 2023 [watching]:

Nippon Felt in 1983, 1991 & 1998 [ bought in '18 & increased in '24]:

Nomura in 1983 [earned 4x, for over

¥109,000 in earnings after waiting from 2018 till 2024]:

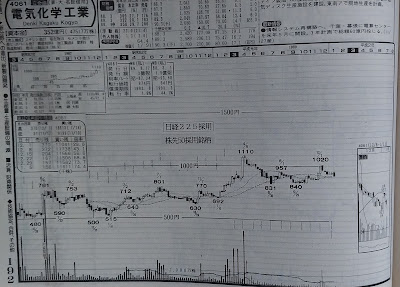

Denka in 1976, 1978, 1984, 1988, 1989, 1990, 1991, 1996, 1998, 2000, 2002,2004,2008,2013, 2019 & 2023 [stalking]:

Murata in 1976, 1978, 1983, 1989, 1991, 1998 & 2013 [stalking but missed]:

Subaru in 1991, 2013, 2016, 2019 & 2023 [earned 10% within 3 months] & Yasunaga in 2019 [watching]:

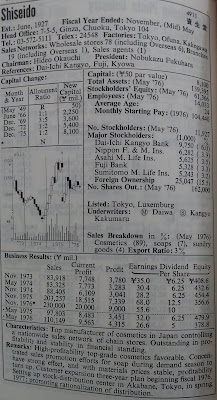

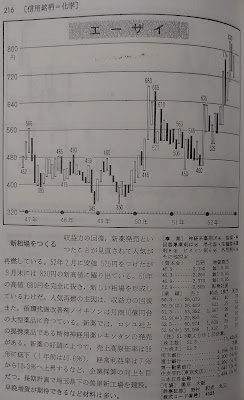

Eisai in 1976, 1978, 1983, 1989, 1991, 1996, 1998, 2002,2005,2019 & 2023 [stalking]:

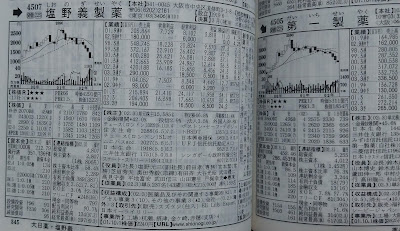

Mochida in 1983,1984, 1991 & 2008 [earned 10% in 2024 after 1 dividend]:

Omron in 1976, 1978, 1983, 1988, 1991, 1996, 1998, 2000, 2002, 2004, 2013, 2016, 2019, 2022 & 2023 [stalking]:

Iseki in 1979, 1983,1991, 2014 & 2023 [watching]:

Ono Pharma in 1976, 1978, 1983, 1984, 1991, 1998, 2002 & 2014 [bought but dropped]:

Yaskawa in 1978, 1991,1998, 2013 & 2023 [stalking] :

Honda in 1983 [ watching] :

Dentsu in 2002, 2005, 2013, 2016 & 2019 [ earned 7% + 1 dividend trading it in '23/'24 & watching for re-entry chance] :

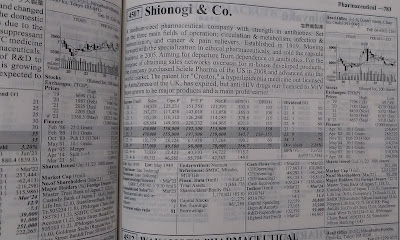

Shionogi in 1976, 1979, 1983, 1991, 1996, 1998, 2002, 2006, 2013, 2016, 2019 & 2023 [ watching]:

Yamaha in 1983, 2023[ bought & SOLD for an 8% gain; chart looks good for medium-long term]:

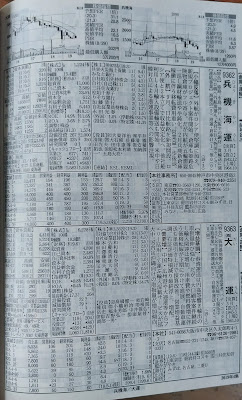

Sumitomo Corp in 1976, 1983 & 1991 [earned 5% trading it within a month in '25]:

FANUC in 1988, 1991 [watching]:

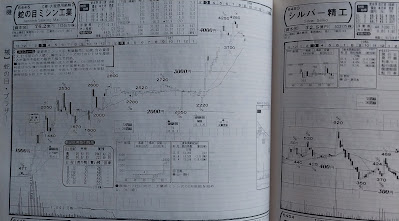

Minebea Mitsumi in 1983, 1989 [ watching ]:

Nippon Chemi-Con in 1983 & 2023 [stalking]:

Kirin in 1976,1978, 1990,1991, 1998, 2013, 2014 & 2023 [ bought, earned 1 dividend & sold for small paper gain ]: