The Record Marathon WIN streak : A Fresh New Year! [4 Jan till 29 Jan 2021]

Goodbye 2020, Hello 2021! The handful of 5-stock-winner days in the prior year was matched on the 1st trading day, 4 Jan, with the sale of Maybank, Tanco warrants, Choo Bee, Hwa Tai & an additional paring of Censof:

This bountiful day gave way to a still rare but more pedestrian triple on 5 Jan : Handal Resources, Federal Int'l & Signature Int'l :

Animal spirits were still vigorous in almost all markets as another rare quartet day was corralled on the 6th with sales of speculative positions in YLI, PolyGlass Fibre, OKA & IQ Group:

On the 7th, the previous day's quartet was replicated with another sale of Censof, APM Automotive, 1-year-ago-repurchased Central Global & Cheetah:

The 1st week of '21 closed with a flourish thanks to another hat3rick of Hong Leong Asia, a further sale of Cheetah & new #17 SYF Resources, comprising the BEST START to a year EVER!

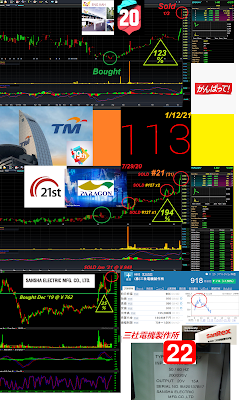

The following week began with S'porean broker UOB-Kay Hian partially sold after 5 years & 5 dividends:Tuesday 12 Jan was very busy with the foursome of TM, rocketing Eng Kah, surging Paragon Union & rising Sansha Electric of Japan, the last of them delivering twice 4 years apart & after a year of holding

[ in @ ¥762, out @ ¥949 ]:The next day, Paragon Union stock surged through the $1 mark & was sold for a 2nd time, as was Choo Bee, with the duo passing the marathon baton on to Petronas Dagangan on Thursday 14 Jan, shares bought at $17.50 the previous October sold @ $21.28, who in turn passed it to a trio of Notion VTec, United U-Li for a +156% gain & Sino Hua-An debuting as the 27th score of '21 while also clinching 5 consecutive years' contributions since its mega win in '17:

The final week of Jan began with Paragon hand-in-hand with Hwa Tai delivering hat3ricks on Monday 25th Jan, the latter surging past 60c the next day & sold a 4th time together with a premature-on-hindsight exit from Dagang NExchange stock bought in 2019 & a 39% gain selling Glotec shares held for just under a year:

Wednesday 27th Jan saw the continuation of Eng Kah's surge, a relentless rise which had begun on the 12th when it was first sold at more than twice the purchase price the previous July above $2.20 vs the 67c entry. The Thaipusam holiday on Thursday 28th Jan was circumvented with a sale of free shares in WABTech listed in the US, a gift from my ownership in General Electric, netting a small US$50 gain. The week & trading month concluded with wonder stocks Cheetah & Paragon, sold the 3rd & 4th times respectively bagging 198% & 317% returns in turn:

Near the end of Jan, I issued a stock pick that would prove to be profitable for clients within a relatively short time frame & which would contribute to the current unbelievable marathon many months later, besides being recommended by The Edge business weekly soon after:

.png)

0 Comments:

Post a Comment

<< Home