Record Marathon : A Miracle Exit at the Top ! [1 Aug till 31 Aug 2023]

#70 Petron M'sia got pared a 5th time at $4.75 on the 1st day of August, handing the laurels back to #69 EP Manufacturing for a 4th sale at $1.02 on the 2nd, thence to maiden winner Quality Concrete on the 3rd for its own 4th round. Shares of #76 Naim plunged 25% since its 4th sale on July 10th and was anxiously pared a 5th time on 4th Aug:

Naim again featured on Monday 7 Aug with a 6th sale, then passed the baton to new #86 Amtel for a 11% gain in less than a month on 8 Aug. A pair of 'lucky' escapes featured on 9 Aug with shares of new #87 TAS Offshore & #88 Handal Resources sold after 5 months & 21 months respectively. Naim returned on 10 Aug for a 7th round before handing back to Petron M'sia for its 6th serving of gains on 11 Aug:

The following fortnight or so featured, with the exception of new #89 Sinmah Capital & fresh #90 GUH's recent warrants, premature-in-hindsight sales of #44 Iskandar Waterfront City & #82 MRCB so no further commentary is needed:

Soap maker PAOS commenced the countdown to 11 consecutive annual centuries as #91 on the 24th of Aug with another premature sale while Tokyo-listed Mitsubishi Estate made it two such sales in a row with just an 8% gain in 5 months on the 25th. Then Iskandar Waterfront City stepped back into the fray with a better-timed hat3rick exit 50% higher than the 2nd round on Monday 28th Aug after leaping the previous two sessions past towards the 70c mark. Another property play LBS Bina assumed the role of new #93 with a 33% return in a few months on the 29th, followed by a reprise from #21 Panasonic[M] on the penultimate day of August securing 760 consecutive days of trading gain:

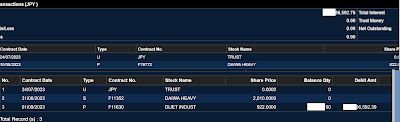

On the final day of the month, which was the local Independence Day & thus a market holiday, a miraculous exit right at the very peak of new #94 Daiwa Heavy Industries at the open of Tokyo trading was made possible by a standing sell order sent the previous day at the limit-up price of ¥2,010. The stock had already gone limit-up on the 30th at ¥1,610. This represented a 144% appreciation on the ¥822 entry made in somewhat of a hurry on Aug 10th because of a hunch based on the firm price movement that day. Gratification augmented greatly when the price rapidly cascaded down the rest of that Aug 31st trading session with only a pair of fleeting counter moves up intraday, ending with a close at the low, down 1 yen! The stock then commenced a relentless multi-month decline with only one or two discernible but brief rebounds back to its starting point a year after its peak!

0 Comments:

Post a Comment

<< Home